how much is meal tax in massachusetts

Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625. If your employer doesnt withhold for Massachusetts taxes you will have to pay those taxes in a lump sum at tax time or make estimated tax payments to the state using form Form 1-ES.

Here S How Much Money You Take Home From A 75 000 Salary

In general the administration said eligible taxpayers will receive a credit in the form of a refund that is approximately 13 of their Massachusetts Tax Year 2021 personal income.

. Dining room meals checks must be serially numbered and used in sequence for all meals served with no number being repeated for a one year period. The base state sales tax rate in Massachusetts is 625. Massachusetts local sales tax on meals More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals.

Exact tax amount may vary for different items. Note that while the statute provides for a 5 rate an uncodified surtax adds 7 to that rate. Anyone who sells meals.

The tax is 625 of the sales price of the meal. The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam and telecommunications services 1 sold or. The Massachusetts state sales tax rate is 625 and the average MA sales tax after local surtaxes.

Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. Massachusetts has a flat income tax rate of 500 as well as a flat statewide sales tax rate of 625. Massachusetts officials announced last week that 3 billion in surplus tax revenue will be returned to taxpayers.

How much is tax on food in Massachusetts. Registering with the DOR to collect the sales tax on meals. The Massachusetts state sales tax rate is 625 and the average MA sales tax after local surtaxes is 625.

The meals tax rate is 625. Sales tax on meals prepared food and all beverages. The states room occupancy excise tax rate is 57.

In addition to the state. Massachusetts imposes a sales tax on meals sold by or bought from. The states income tax rate is only one of a handful of states that levy a flat rate.

Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625. 625 A city or town may also charge a. The Massachusetts state sales tax rate is 625 and the average MA sales tax after local surtaxes.

State Auditor Suzanne Bump announced Thursday that she had. 2022 Massachusetts state sales tax. The base state sales tax rate in Massachusetts is 625.

With the local option the meals tax rises to 7 percent. A 625 state meals tax is applied to restaurant and take-out. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant.

Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. Massachusetts has a 625 statewide sales tax rate and does not allow local governments to collect sales taxes. Collecting a 625 sales tax and where applicable a 75 local option meals excise on.

All restaurant food and on-premises consumption of any beverage in any amount. Dining room meals checks. The state meals tax is 625 percent.

Nmtc Funding For The Food Bank Mascoma Bank

Branford Massachusetts 1953 Postcard Oasis Restaurant Dining Room Interior Ebay

Scrap The Massachusetts Meals Tax For Now Phil Osophy

Is Food Taxable In Massachusetts Taxjar

Exemptions From The Massachusetts Sales Tax

Sales Tax By State To Go Restaurant Orders Taxjar

Everything You Need To Know About Restaurant Taxes

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Massachusetts Tries New Bite At Sales Tax Revenue By Focusing On Internet Cookies

Dor Tax Due Dates And Extensions Mass Gov

Form St Mab 4 Fillable Sales Tax On Meals Prepared Food And Or Alcoholic Beverages For The Months Of August 2009 And The Months Thereafter

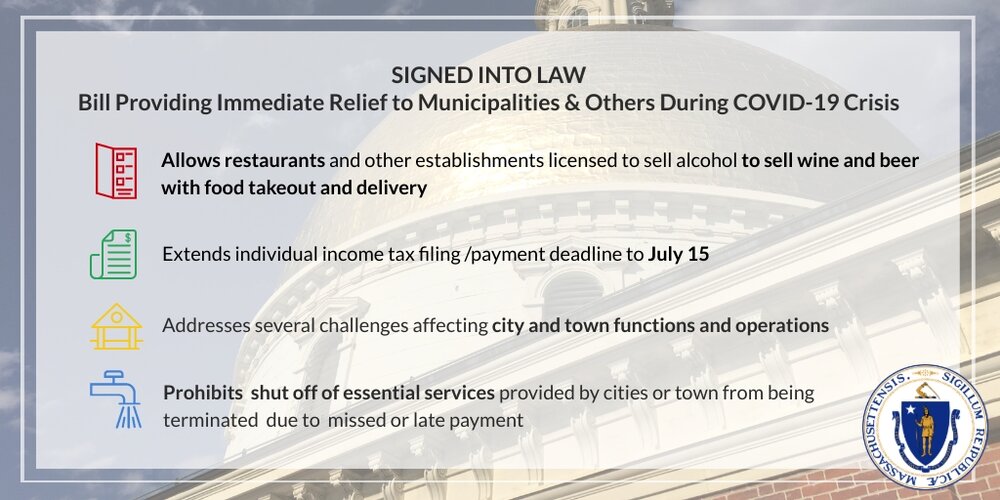

Massachusetts Legislature Passes Bill To Provide Immediate Relief To Municipalities And Others During The Ongoing Covid 19 Crisis Senate President Karen E Spilka

Massachusetts Who Pays 6th Edition Itep

New England Food Show Ma Restaurant Association Mra Recovery Update For 9 15 20 Announcement Deferring Meals Tax Due On 9 20 Https Conta Cc 3mpzt4s Facebook

Massachusetts Income Tax Calculator Smartasset

Further Tax Delays Not Enough To Help Devastated Restaurant Hotel Industries

Massachusetts Estate Tax Everything You Need To Know Smartasset

Order Your Thanksgiving Meal From Lakeview Pavilion Foxborough Ma Patch